Последняя версия

Версия

4.0

4.0

Апдейт

май 16, 2025

май 16, 2025

Разработчик

Rohit Aneja

Rohit Aneja

Категории

Инструменты

Инструменты

Платформы

Android Apps

Android Apps

Загрузки

0

0

Лицензия

Бесплатно

Бесплатно

Название пакета

com.rohit.xteam.indiaincometaxcalculator

com.rohit.xteam.indiaincometaxcalculator

Репорт

Сообщить о проблеме

Сообщить о проблеме

Подробнее о Income Tax Calculator

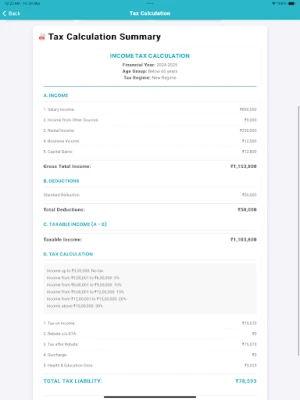

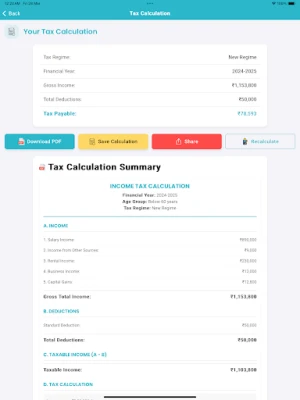

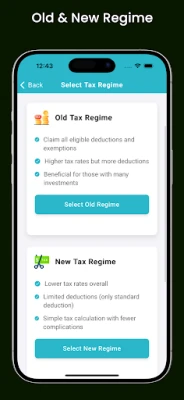

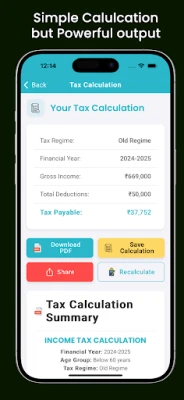

Income Tax Calculator is your essential companion for accurate and hassle-free tax calculations under both the old and new tax regimes.

Disclaimer: This app is not affiliated with or endorsed by the Government of India. It is an independent tool for informational purposes only. Users should verify tax-related information with official government sources.

Source of data: https://www.incometax.gov.in/iec/foportal/

Calculate with Confidence

• Support for both old and new tax regimes

• Tax calculations for all financial years from 2020-2025

• Age-based tax slabs (below 60, 60-80, and above 80 years)

• Completely offline - your data stays on your device

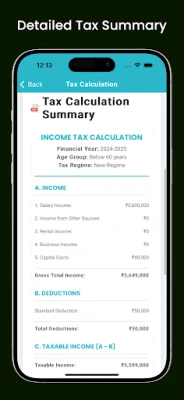

Comprehensive Income Sources

• Salary income

• Rental income

• Business income

• Capital gains

• Other income sources

Full Deduction Support

• HRA exemption

• Standard deduction

• Professional tax

• Section 80C investments (up to ₹1,50,000)

• NPS contributions

• Health insurance premiums

• Education loan interest

• Donations

• Savings bank interest

• Disability deductions

Professional Features

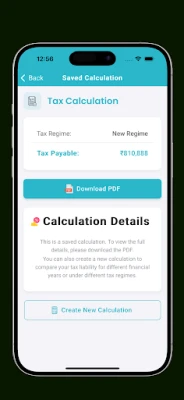

• Generate detailed PDF reports of your tax calculations

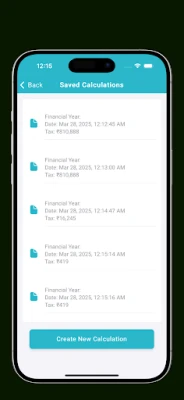

• Save and review previous calculations

• Share tax reports via email or messaging apps

• Clean, intuitive interface for easy navigation

Whether you're a salaried professional, business owner, senior citizen, or tax consultant, this app provides the perfect tool to quickly calculate tax liability and compare between old and new tax regimes.

Source of data: https://www.incometax.gov.in/iec/foportal/

Calculate with Confidence

• Support for both old and new tax regimes

• Tax calculations for all financial years from 2020-2025

• Age-based tax slabs (below 60, 60-80, and above 80 years)

• Completely offline - your data stays on your device

Comprehensive Income Sources

• Salary income

• Rental income

• Business income

• Capital gains

• Other income sources

Full Deduction Support

• HRA exemption

• Standard deduction

• Professional tax

• Section 80C investments (up to ₹1,50,000)

• NPS contributions

• Health insurance premiums

• Education loan interest

• Donations

• Savings bank interest

• Disability deductions

Professional Features

• Generate detailed PDF reports of your tax calculations

• Save and review previous calculations

• Share tax reports via email or messaging apps

• Clean, intuitive interface for easy navigation

Whether you're a salaried professional, business owner, senior citizen, or tax consultant, this app provides the perfect tool to quickly calculate tax liability and compare between old and new tax regimes.

Оцените приложение

Добавить комментарий и отзыв

Отзывы пользователей

Основано на 0 reviews

Отзывов пока не добавлено.

Комментарии не будут допущены к публикации, если они являются спамом, оскорбительными, не по теме, содержат ненормативную лексику, содержат личные выпады или разжигают ненависть любого рода.

Ещё »

Популярные приложения!

TMA For Julia AIСорокин Дмитрий Олегович (@sorydima)

MarinaСорокин Дмитрий Олегович (@sorydima)

Marina for HUAWEIСорокин Дмитрий Олегович (@sorydima)

MarinaСорокин Дмитрий Олегович (@sorydima)

TMA For Basique 7.13Сорокин Дмитрий Олегович (@sorydima)

REChain TMAСорокин Дмитрий Олегович (@sorydima)

JuliaAIPWAСорокин Дмитрий Олегович (@sorydima)

Basique 7.13 For Aurora OSСорокин Дмитрий Олегович (@sorydima)

REChain ®️ 🪐Сорокин Дмитрий Олегович (@sorydima)

Julia AIСорокин Дмитрий Олегович (@sorydima)

Ещё »

Выбор редактора

TMA For Julia AIСорокин Дмитрий Олегович (@sorydima)

JuliaAI Aurora OSСорокин Дмитрий Олегович (@sorydima)

JuliaAIPWAСорокин Дмитрий Олегович (@sorydima)

Julia AIСорокин Дмитрий Олегович (@sorydima)

TMA For Basique 7.13Сорокин Дмитрий Олегович (@sorydima)

Basique 7.13 For Aurora OSСорокин Дмитрий Олегович (@sorydima)

Basique 7.13Сорокин Дмитрий Олегович (@sorydima)

My Modus For Aurora OSСорокин Дмитрий Олегович (@sorydima)

Marina For Aurora OSСорокин Дмитрий Олегович (@sorydima)

Катя ® 👽 for SlackwareСорокин Дмитрий Олегович (@sorydima)

Все платформы »

Web PWA

Web PWA HARMONY OS

HARMONY OS ОС Аврора

ОС Аврора Polkadot

Polkadot Ethereum

Ethereum BNB

BNB Base Blockchain

Base Blockchain Polygon

Polygon Gnosis

Gnosis Arbitrum

Arbitrum Linea

Linea Moonbeam

Moonbeam Aptos

Aptos Solana

Solana THORChain

THORChain TONChain

TONChain PYTH Network

PYTH Network